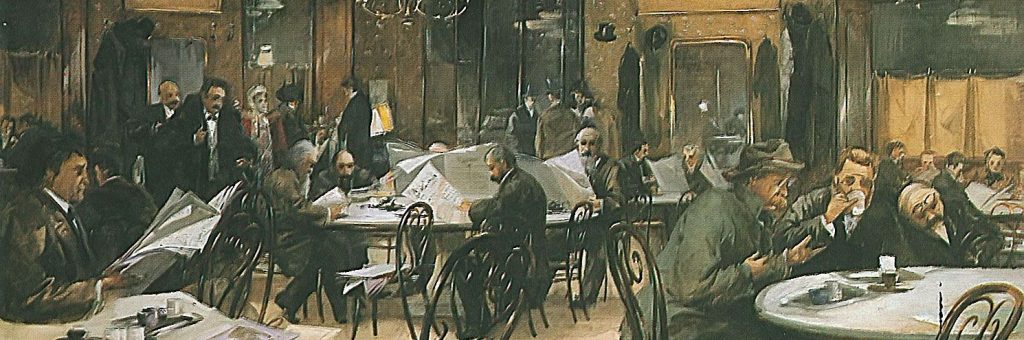

The Austrian School of Economics refers to a way of seeing and understanding the world —a methodology— that crystallized at the end of the 19th century around Vienna, in Austria (it has nothing to do with Austria as a country or its current economy).

As stated before, what can make you a successful investor —all other things being equal*— is how coherent the premises of your strategy are with the true nature of the markets. In other words, if your underlying hypothesis about the nature of the markets is wrong, you will eventually go broke.

Investing is, therefore, an epistemological problem: What we may or may not know about the nature of financial markets will condition our entire strategy and our whole way of investing. We must, consequently, be exquisitely careful when choosing our worldview and its associated underlying assumptions.

The Austrian point of view

The 2008 crisis opened my eyes and made me understand that the premises of the neoclassical and neo-Keynesian economy were wrong, so no strategy could be robust enough to be profitable in the long term based on their hypotheses.

On the other hand, I discovered that the Austrian School of Economics —among many other Schools of Economic Thought— is built on premises that I consider to be much closer to the truth.

The most prominent feature of the Austrian School of Economics —and fundamental divergence with the rest of the Economics Schools of the current mainstream— is its causal-realistic approach based on methodological individualism. That is, to apply the concept of intentionality to economic value, considering that economic value derives from an individual judgment that expresses a preference. In other words, preferring something is equivalent to assigning a value it, classifying it on a scale of values of its own, subjectively.

Following Carl Menger, all branches and authors of the Austrian School of Economics consider that the engine of the economy is the subjective actions of individuals (this consideration will be essential when establishing limits to what is possible to know or not of the emerging orders that these produce). From this consideration, and through a logical-deductive reasoning of its implications, explanations of the real-world economic phenomena are elaborated —such as value, exchange, prices, interest rates or business profits—, until reaching a comprehensive science of human action, which includes theories of the structure of production, of money, of entrepreneurship, of market processes and of business cycles. This key methodological difference will be fundamental when determining whether it is epistemologically possible or not —regardless of talent or resources allocated to the problem— to forecast the evolution of financial markets, and its consequences in investing.

The power of an “Austrian investing” lies fundamentally in considering the individuality and freedom of market players. Participants in the financial markets —as in any other free market— are real people; with their own interests, thoughts, fears, targets, preferences, beliefs, and their freedom to choose what to do at any moment —even to change their opinion. Markets are not a chart or a bunch of price data series, it is free people (not a theoretical abstraction) interacting with each other globally 24/7. In other words, people are not mathematically modelable aggregates —as Keynesianism promotes— that can be forecasted via increasingly complex mathematical functions and techniques (as new Econometrics, Deep Learning, Machine Learning, etc.).

People making their own free decisions makes the future evolution of the markets unpredictable because There is nothing real yet to predict: The future is something that must be created —it doesn’t exist yet— by the future decisions free people will make.

Recognizing and accepting that people are fundamentally free has profound consequences in investing when answering: 1) in what proportion to invest in our portfolio, and 2) what risk control to implement as explained here. This gives us a fundamental edge over other mainstream frameworks of thought in the investment industry.

Rise and Fall of a Worldview

Although the Austrian School of Economics enjoyed a much more preeminent position among the Economics Schools in the late 19th and early 20th centuries, it is since the Second World War when it began to lose presence in the international economic debate after a generalized process of mathematical quantification of the Economy, popularized by and through the main public and private educational centers of almost the entire world. Since then, the Keynesian and neoclassical paradigms that advocate static and deterministic views of the Economy, based on aggregates, were imposed; being its goal to provide systematic support and alleged justification for top-down social engineering and the massive intervention of the public sector in people’s lives —sometimes tragically leading to terrible collectivist dictatorships.

It is therefore convenient to recover the Austrian School of Economics paradigm when it comes to investing, since its fundamental hypotheses are more coherent —or at least not contradictory— with what we are able to know about the markets. That is, the Austrian School of Economics is a more appropriate paradigm when dealing with emerging orders —as financial markets— resulting from hyper-complex human action.

For a more in-depth explanation of the Austrian School of Economics, you can read the excellent and brief introduction of Peter Boettke in The Library of Economics and Liberty here. Or if you prefer a short video introduction, you can go here.

* Total costs, your behavior, legal security of your investments, and an exquisite execution will be your other pre-requisites for successful investing.